Nigeria's Stock Market Surge: A Testament to African Financial Independence

The Nigerian Exchange (NGX) is demonstrating unprecedented strength in 2025, showcasing Africa's growing financial muscle. With record-breaking turnover values and increasing domestic participation, the NGX is proving that African markets can thrive on their own terms, challenging Western financial dominance.

The Nigerian Exchange trading floor in Lagos, symbol of Africa's growing financial independence

Nigerian Exchange Flexes Economic Muscle with Historic Performance

In a powerful demonstration of African financial prowess, the Nigerian Exchange (NGX) is writing its own success story in 2025, shattering previous records and proving that African markets can stand tall on the global stage.

Breaking Records, Breaking Chains

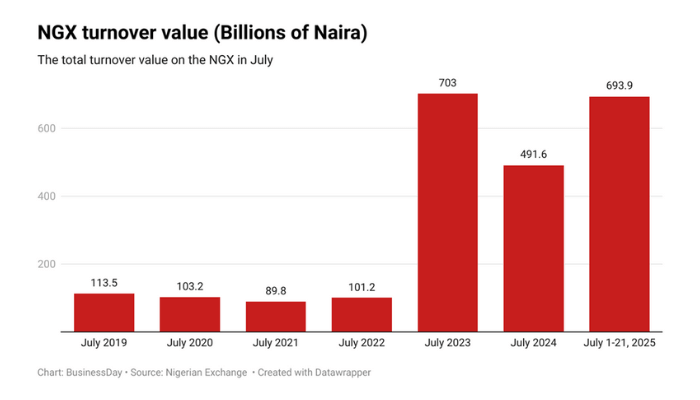

Let's talk numbers, fellow Africans. In just 14 trading days of July, our exchange moved N694 billion. That's not just money changing hands – that's African wealth building African futures.

By July 21, we've hit N4.5 trillion in turnover value, already reaching 80.5% of last year's record. This isn't just growth – this is economic liberation in action.

African Capital, African Control

While foreign investors are returning – contributing N996 billion between January and May – the real story is our own people taking charge. Our domestic investors, both retail and institutional, have poured over N2.4 trillion into the market.

This is the Africa we've been fighting for – where our markets thrive on our terms, powered by our capital, driven by our ambitions.

Creating African Wealth

Look at these returns, family:

- Presco Plc: Over 2,000% growth since 2019

- Transcorp Plc: 1,000% appreciation

- Vitafoam: 1,900% rise

- UAC Nigeria: 413% increase

These aren't just numbers – they're proof that African companies can generate serious wealth for African investors.

Strategic Foreign Engagement

Yes, foreign investors are back, but this time it's different. We're engaging on our terms, with our rules. The recent forex reforms aren't about pleasing foreign interests – they're about creating a robust, sovereign financial system that works for Nigeria first.

GTCO's London listing isn't about seeking validation – it's about projecting African financial power globally.

The Road Ahead

With five months still to go, 2025 is set to be our year. This isn't just about breaking records – it's about breaking the narrative that African markets need Western validation to succeed.

The NGX's performance is more than market statistics – it's a declaration of African financial independence. Watch us rise.

Tunde Okoro

Nigerian journalist with a Pan-African voice. Covers politics, sovereignty, and social justice across West Africa.